Utilizing both bank debt and private placements can help a business achieve its strategic goals while simultaneously minimizing funding risk.

Savvy managers who understand the pros & cons of the bank market and private placement market can use both funding sources tactically to optimize their capital structure as well as enhance their liquidity risk management.

Middle-market companies will often rely exclusively on traditional bank debt financing to fund capital needs that exceed internally generated cash flow. They tend to find their need for debt capital expands meaningfully, either as a result of natural growth, capital investment, business acquisitions, or because of a company’s need to alter its ownership or capital structure. In instances such as these, companies will often pursue a private placement debt financing as a means of diversifying and complementing their existing bank lending arrangement.

A private placement is a common term used to describe the private sale, or “placement,” of corporate debt or equity securities by a company, or “issuer,” to a limited number of investors.

Private placements are typically event driven; they are often issued when the following opportunities or needs arise:

- Debt refinancing

- Debt diversification

- Expansion/growth capital

- Acquisitions

- Stock buyback/recapitalization

- Taking a public company private

- Employee Stock Ownership Plan (ESOP)

"A private placement issuance allows institutional investors to lend directly to companies in a similar fashion as banks."

Private placement investments are generally completed directly by large private investment firms, such as insurance companies, pension plans or other large institutional investors. A private placement issuance allows institutional investors to lend directly to companies in a similar fashion as banks. Like banks, institutional investors who purchase private placements do so with a "buy-and-hold" approach to lending, and thus are not beholden to the normal public information disclosures and rating requirements associated with public securities offerings. Businesses can also access the private placement market through an intermediary or agent (most often an investment bank) to the extent that the issuer desires to place its debt with several different institutions.

Insurance companies refer to the act of private placement lending as purchasing “notes,” while banks make “loans.” Accessing capital under a traditional bank credit arrangement and through a private placement relationship are not mutually exclusive events. Properly executed, companies can do both, establishing access to a broader palate of stable capital in support of their long-term corporate objectives.

Here are 7 ways a private placement complements and differs from a bank loan:

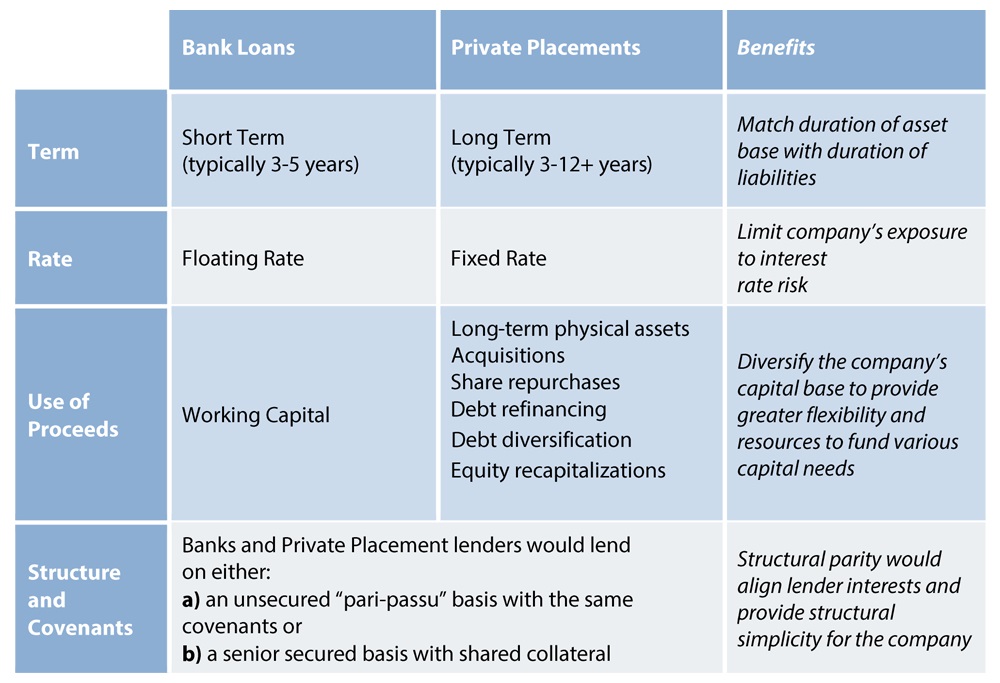

1. Long-Term vs. Short-Term Orientation – Bank loan commitments tend to be shorter term (typically 3-5 years), whereas private placements offer longer maturities (typically 3-12+ years). Because of this, a private placement is generally well-suited for financing the long-term goals of a business, such as growth by way of an acquisition or to finance a new plant and equipment assets. Alternatively, the short-term nature of bank loans makes them more suited for fluctuations in working capital. The long-term nature of private placements allows companies more time to realize a return on their investment as well as minimizes the refinancing risk that comes with shorter-term debt maturities.

"The breadth and investment appetite of the private placement market can often equal or exceed that of the syndicated bank market."

2. Broadens Capital Pool – The introduction of private placement financing to existing bank debt expands the pool of capital available to companies; they would have multiple types of capital to draw from depending on the need at hand. The breadth and investment appetite of the private placement market can often equal or exceed that of the syndicated bank market.

3. Diversifies Capital Structure – The combination of bank loans and private placement financing diversifies a company’s capital base, better preparing them for any changes to interest rates and other issues that could arise with taking on only one type of debt. Private placement investors are often able to consider financing arrangements that extend beyond senior debt to include junior capital and equity, as well.

4. Minimizes Fees – While banks rely on ancillary services and fee generation to enhance investment return, private placement lenders rely solely on the yield they receive from their loans. As a result, the investor’s interest in lending is not dependent upon “expectations” for future fee income, better aligning issuer and lender interests over the life of the lending relationship.

"Reduced dependence on a single market for capital can be an important consideration for companies should bank regulators become more stringent, or during times of heightened public market volatility."

5. Regulatory and Market Independence – The private placement market and the insurance companies and pension plans that participate in the market are not subject to governance by the Office of the Comptroller of the Currency (OCC) and the regulations that impact bank lending practices. Similarly, the private placement market is often seen as a more stable market than the public debt markets, and is “open for business” at times when the broader public debt market is “closed.” Reduced dependence on a single market for capital can be an important consideration for companies should bank regulators become more stringent, or during times of heightened public market volatility.

6. Contrasting Capitalization – Private placement investors are capitalized differently than banks. The capital that they have to deploy is traditionally more stable than that which the bank market relies upon. Insurance companies and pension plans are not materially exposed to short-term liquidity risk. This was most acutely demonstrated during the 2008-2009 financial crisis, as many private placement lenders continued to provide capital, while many banks limited their lending availability in an effort to preserve corporate liquidity.

7. Structural Parity – When combining bank debt with a private placement, transactions are often completed on a "pari-passu" basis. In this manner, both the bank lenders and private placement lenders work together to maximize the company’s access to low cost capital, while ensuring that neither lender group is disadvantaged by structure and its rights as a senior lender. For transactions involving collateral, the private placement structure is typically negotiated and documented with an intercreditor agreement that governs how collateral proceeds are shared equitably between lenders in the event of a liquidation. If a bank loan is unsecured, private placement notes will most likely also be unsecured, and an intercreditor document is typically not required.

Ensuring that private placement debt is pari-passu with all other senior debt obligations, including bank loans, is the most efficient and cost-effective way to issue debt in the private placement market. This approach also improves the ability to work with lenders on any post-transactions modifications and amendments that may be needed over the life of the financing.

Let’s Look at a Side-by-Side Comparison of Bank Loans and Private Placements

The combination of private placement financing and bank debt can play an important role in a company's business strategy, providing the capital needed to operate on both a day-to-day basis as well as funding initiatives that support growth for years to come.

It’s not easy for companies to find a capital provider that can tailor terms and structures to meet their specific financing needs. With more than 20 years of history in structuring and investing in the private market, Defoe Redmount can implement a customized private placement that best suits your liquidity objectives, and provides financial support that coordinates with your bank facility rather than competes with it.