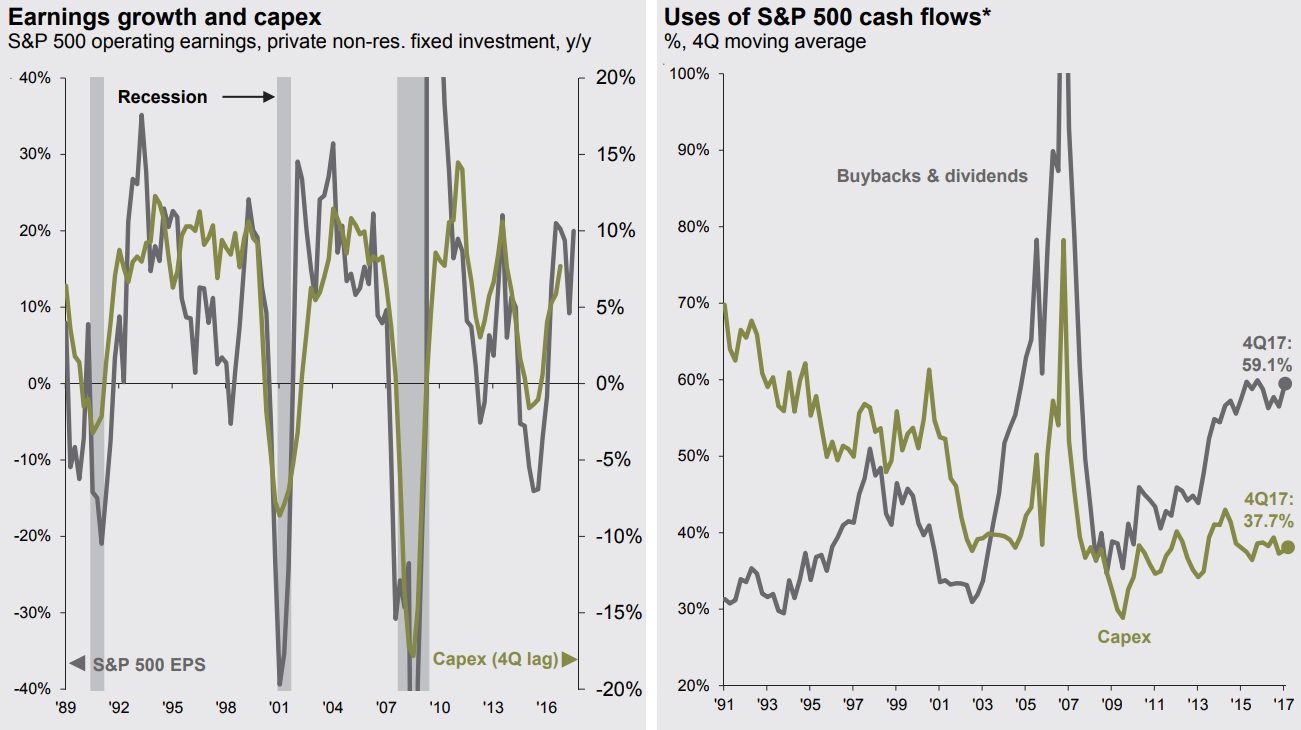

During this recovery and BUSINESS cycle corporations prefer payouts vs Capex One hallmark of current recovery and business cycle has…

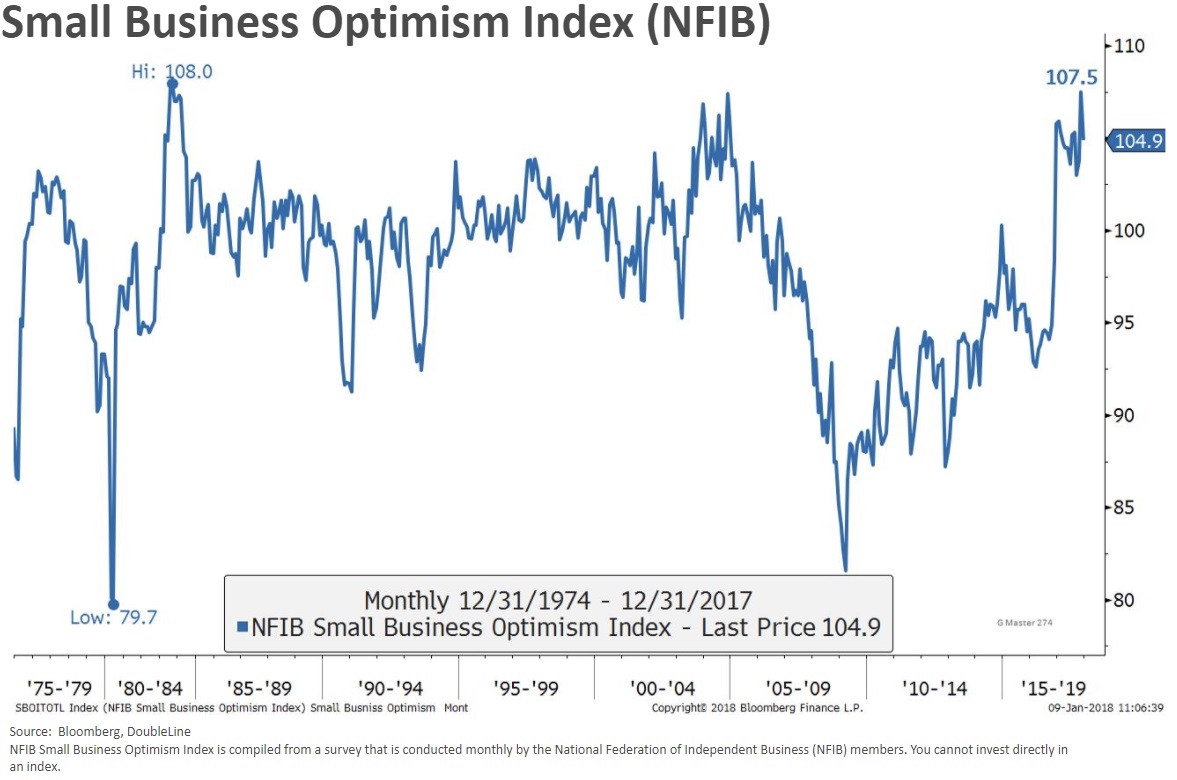

Small Business Optimism Index is near to the highest recorded level of 1981. The Index indicates strong economic prospects It…

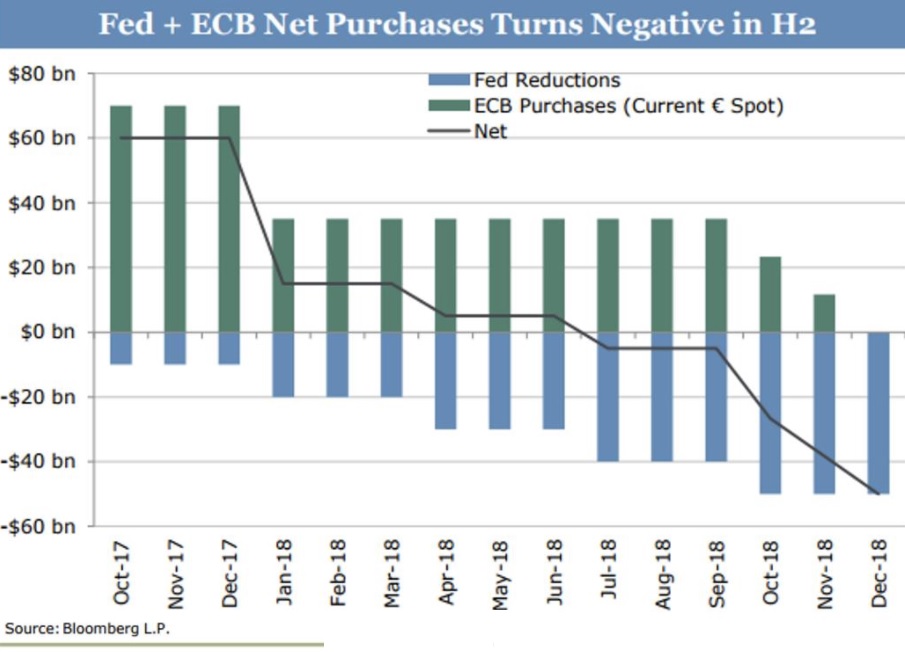

U.S. Federal Reserve and EU Central Bank are planning to reduce money supply during 2018. U.S. Fed plans to continue…

Corporations are maintaining historically high levels of cash distributions to shareholders via dividends and/or stock buybacks. While stock buyback levels…

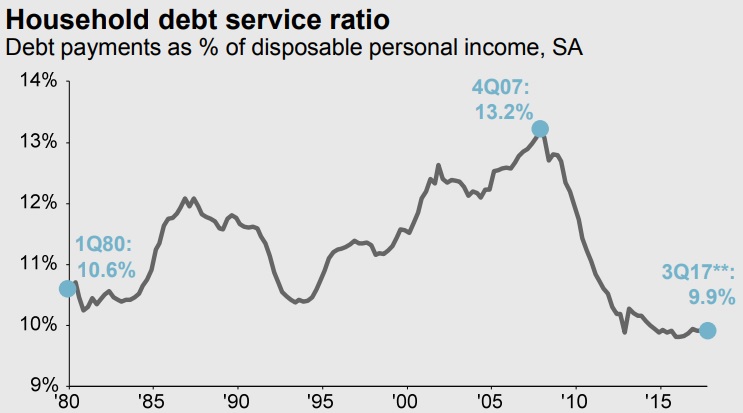

Aided by lower interest rates household debt service ratio persists at low levels U.S. households embarked on historic deleveraging starting…

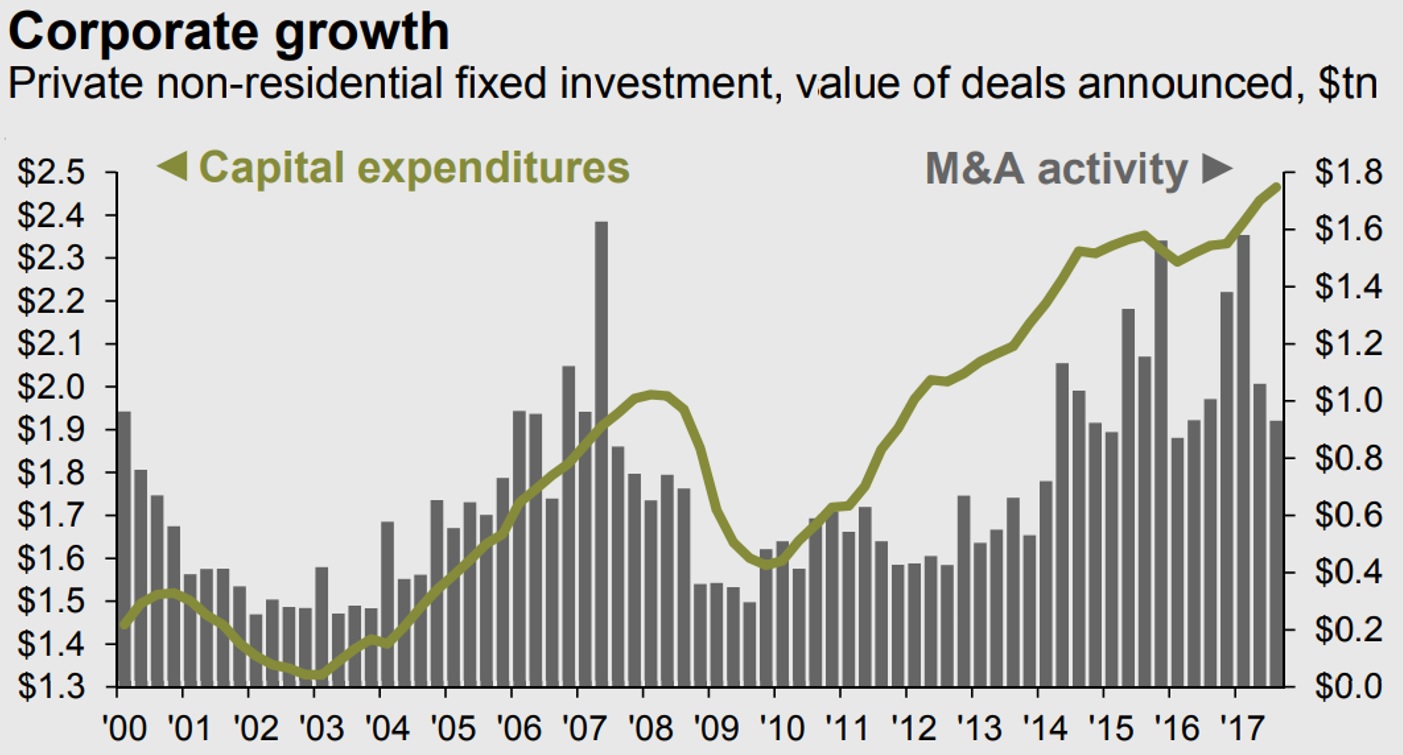

Corporate spending on M&A and capital expenditures (CapEx) is driving U.S. and Global economic growth. The chart is comparing amounts…

You’ve probably heard a lot about initial public offerings (IPOs)—but how much do you really know about the costs and…

From global growth to changes in the labor market, these are the economic takeaways to know about the third quarter.…

Analysts at Defoe Redmount see a six-day route from Northern Europe to South Korea, Japan and NE China as a…

WEEKLY MARKET RECAP – Intl. trade in goods deficit up to -$65.1B Case-Shiller HPI +5.7% y/y Cons. conf. at 122.9;…