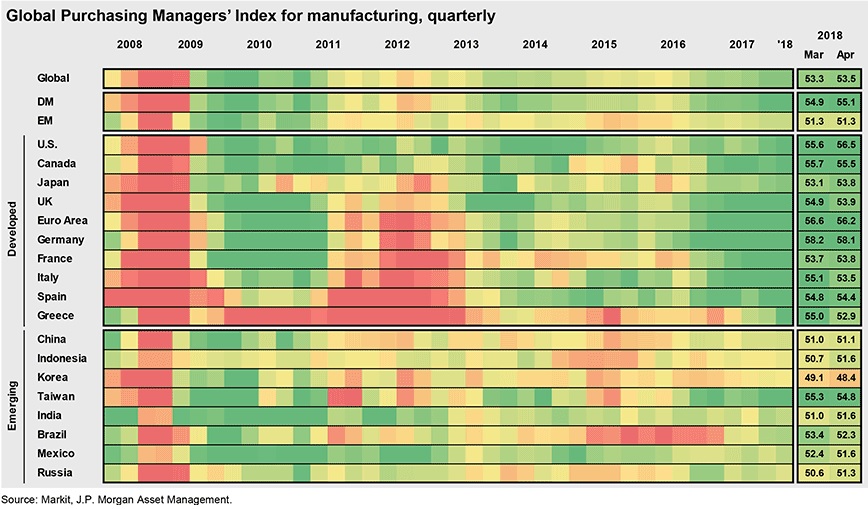

After two years of very mediocre growth and various setbacks over the last decade, the global economy started to show…

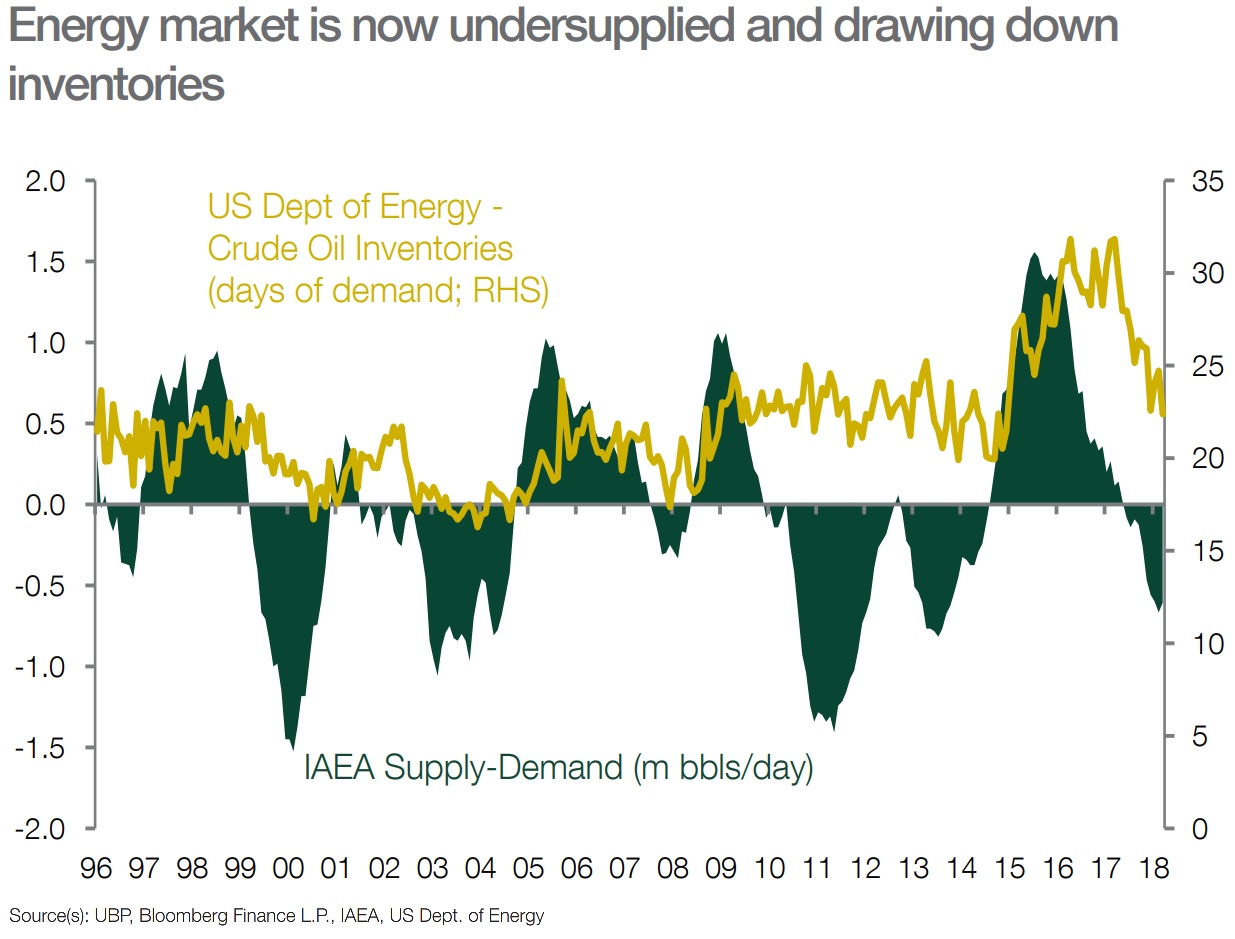

Energy sector out-performance lies ahead Having ended 2017 as one of the worst performing global sectors, sustained out-performance lies ahead…

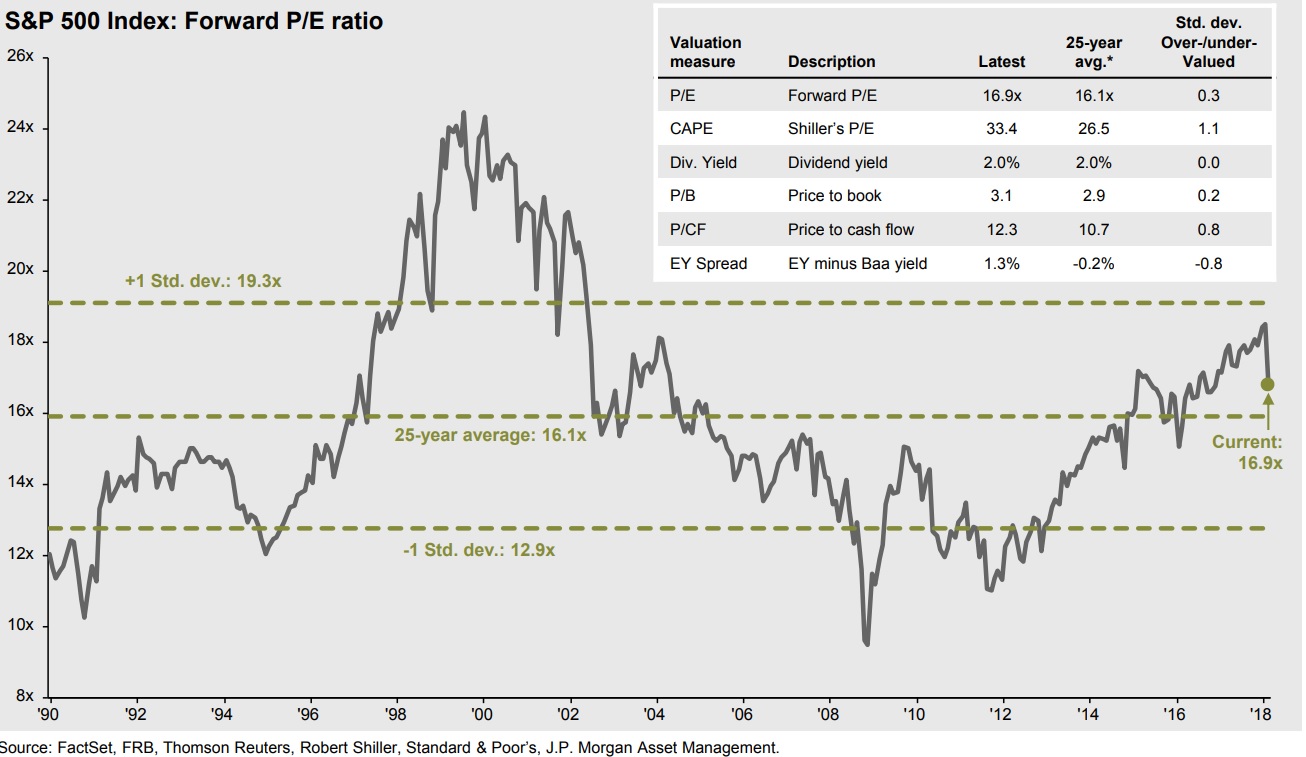

After a solid bull market, a key concern of many investors is – are the markets overvalued? Lets look at…

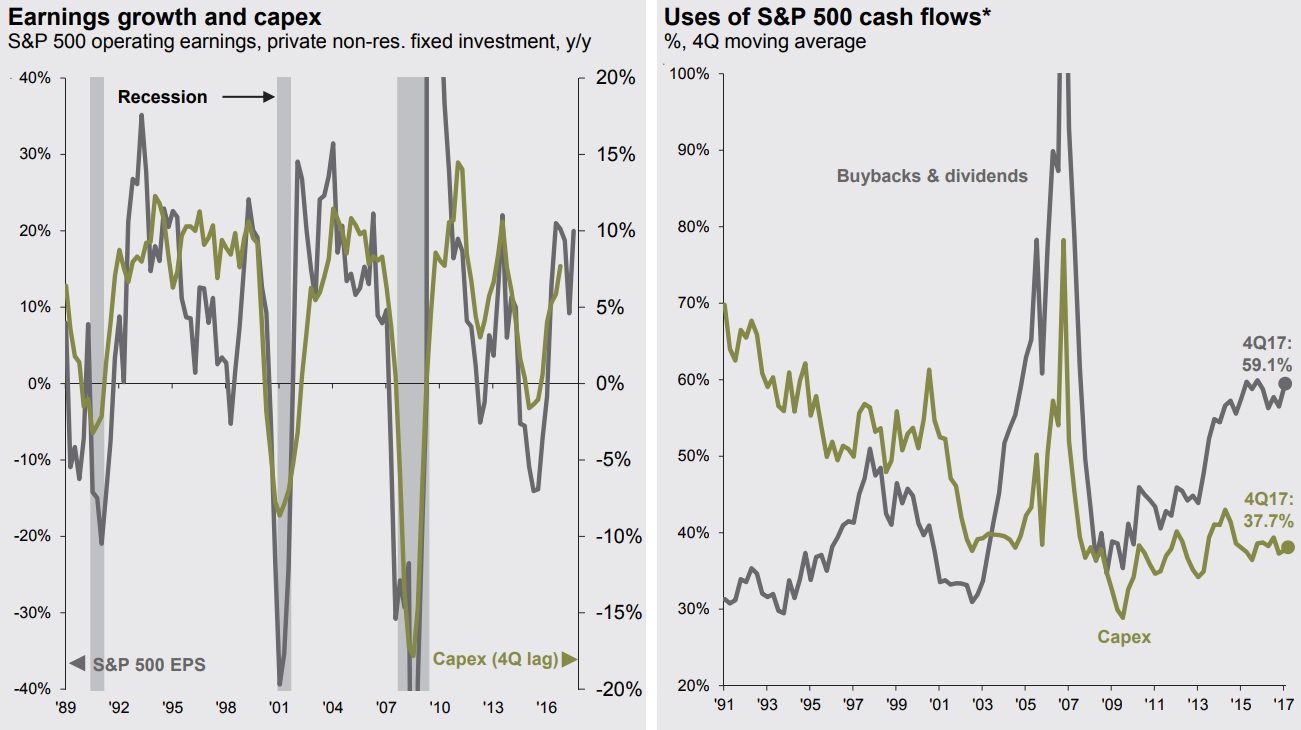

During this recovery and BUSINESS cycle corporations prefer payouts vs Capex One hallmark of current recovery and business cycle has…

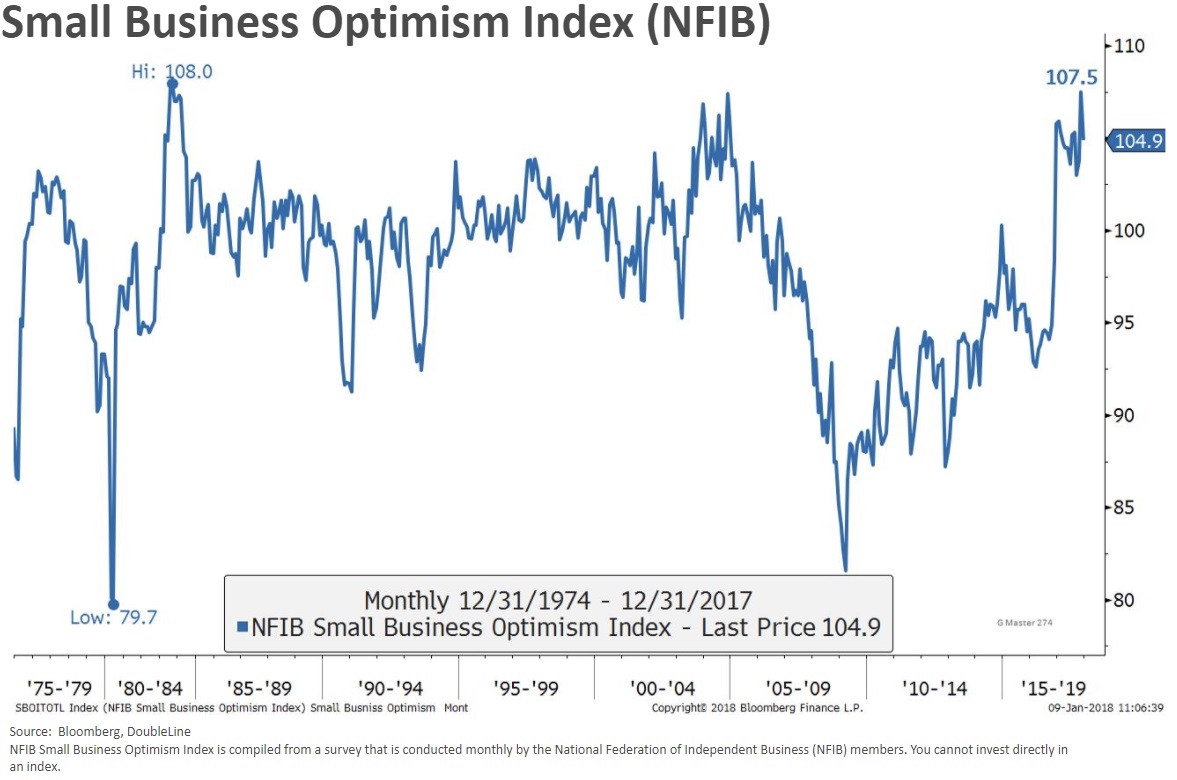

Small Business Optimism Index is near to the highest recorded level of 1981. The Index indicates strong economic prospects It…

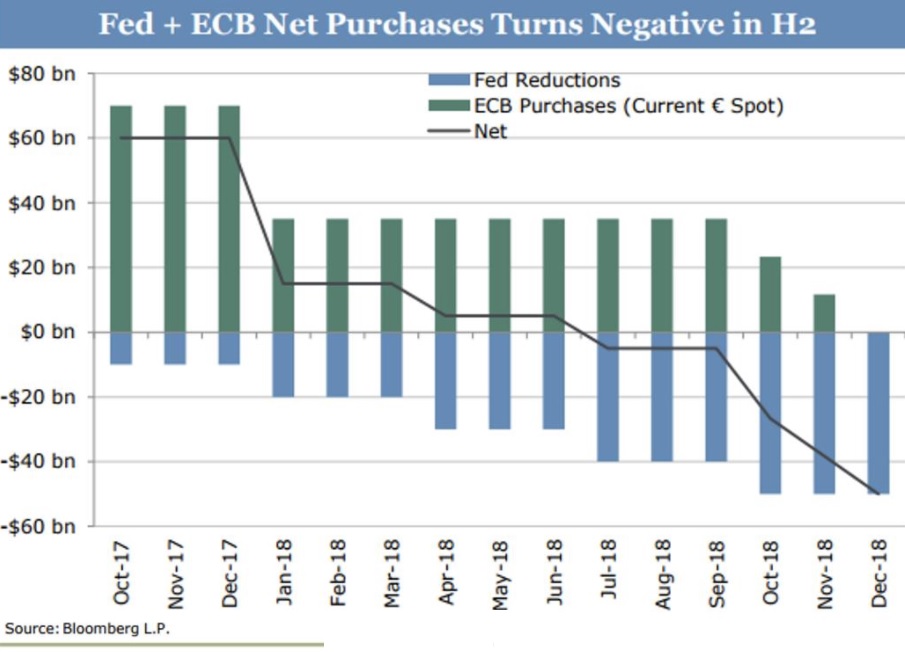

U.S. Federal Reserve and EU Central Bank are planning to reduce money supply during 2018. U.S. Fed plans to continue…

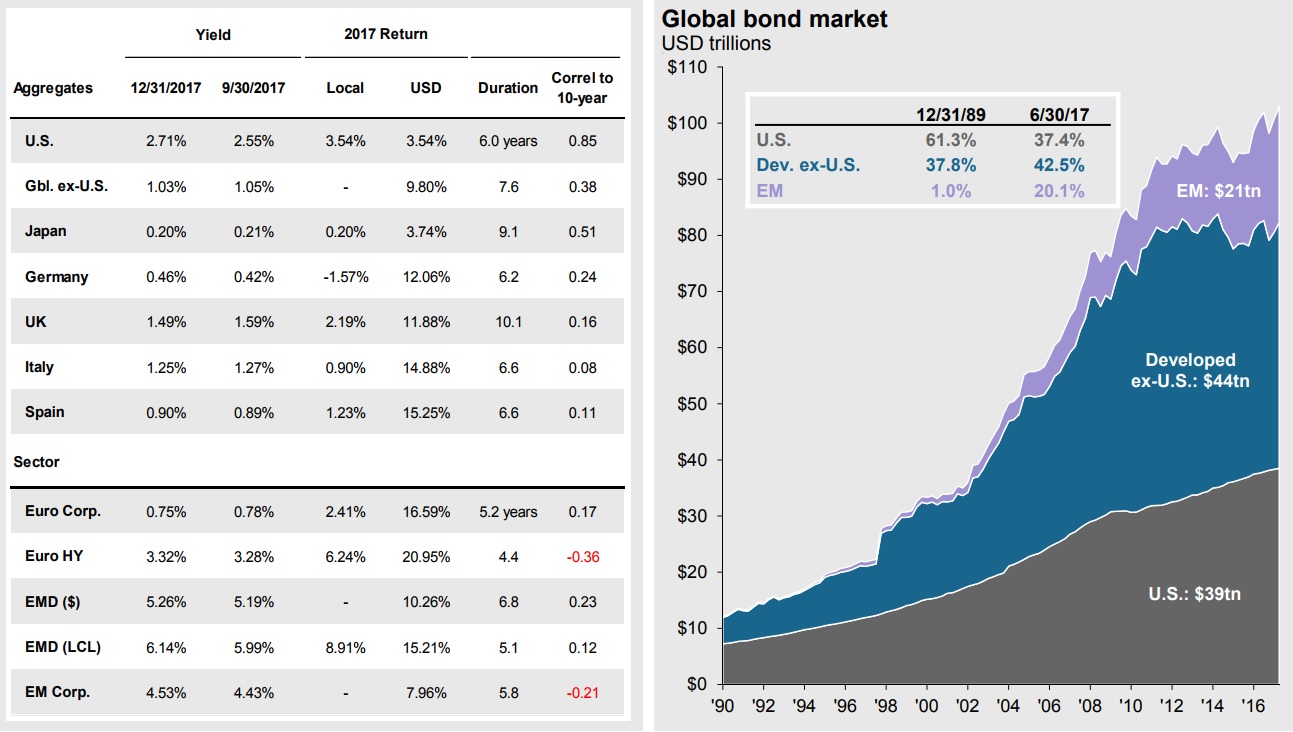

With most central banks tightening money supply and increasing rates what to expect of global fixed income markets Across developed…

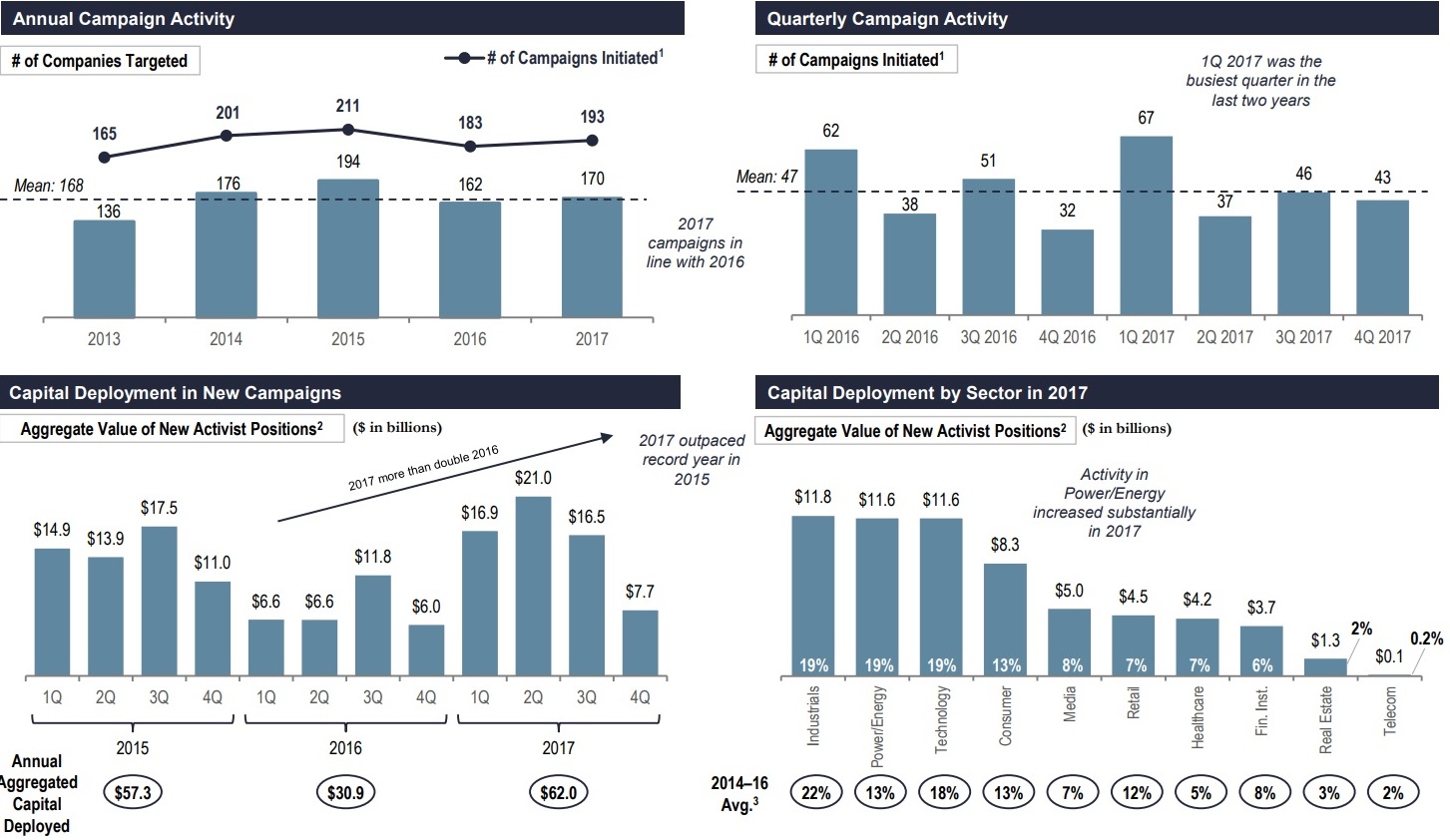

Activists deployed a record amount of capital in 2017, leveraging their credibility with traditional shareholders and access to large pools…

Corporations are maintaining historically high levels of cash distributions to shareholders via dividends and/or stock buybacks. While stock buyback levels…

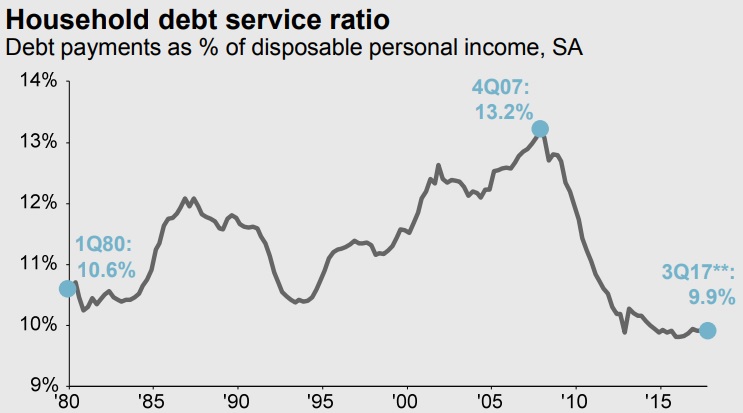

Aided by lower interest rates household debt service ratio persists at low levels U.S. households embarked on historic deleveraging starting…