In 2011, we supported the creation of When Bankers Were Good, a documentary about a time when banks and bankers were…

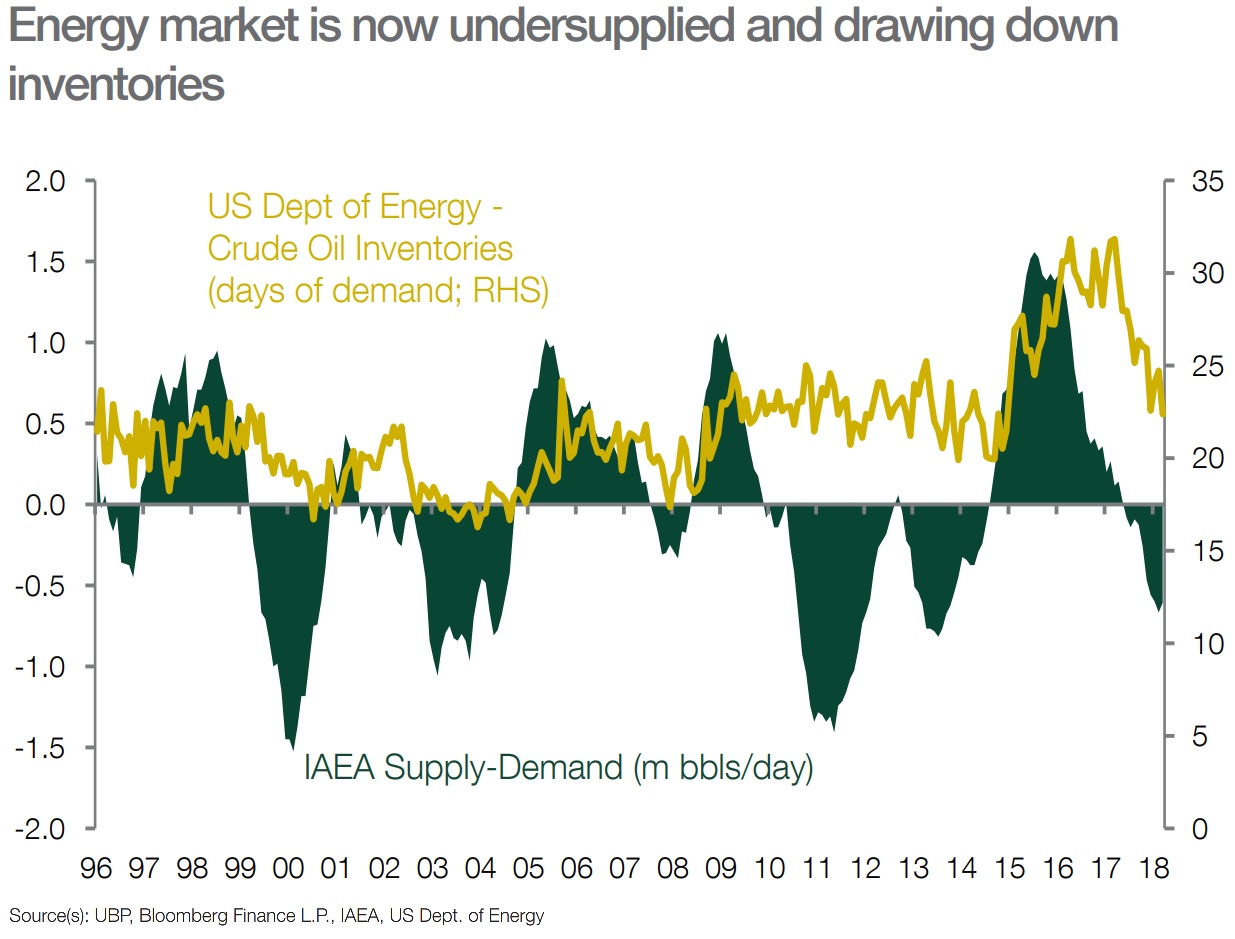

Energy sector out-performance lies ahead Having ended 2017 as one of the worst performing global sectors, sustained out-performance lies ahead…

Selling shares in a business completely (or partially) income tax-free sounds too good to be true, right? Perhaps not. To the delight…

owners of long cash conversion businesses are finding alternative funding solutions such as invoice finance are allowing them to execute…

The speech will be about how business owners may leverage tailored growth and exit strategies to monetize their business value,…

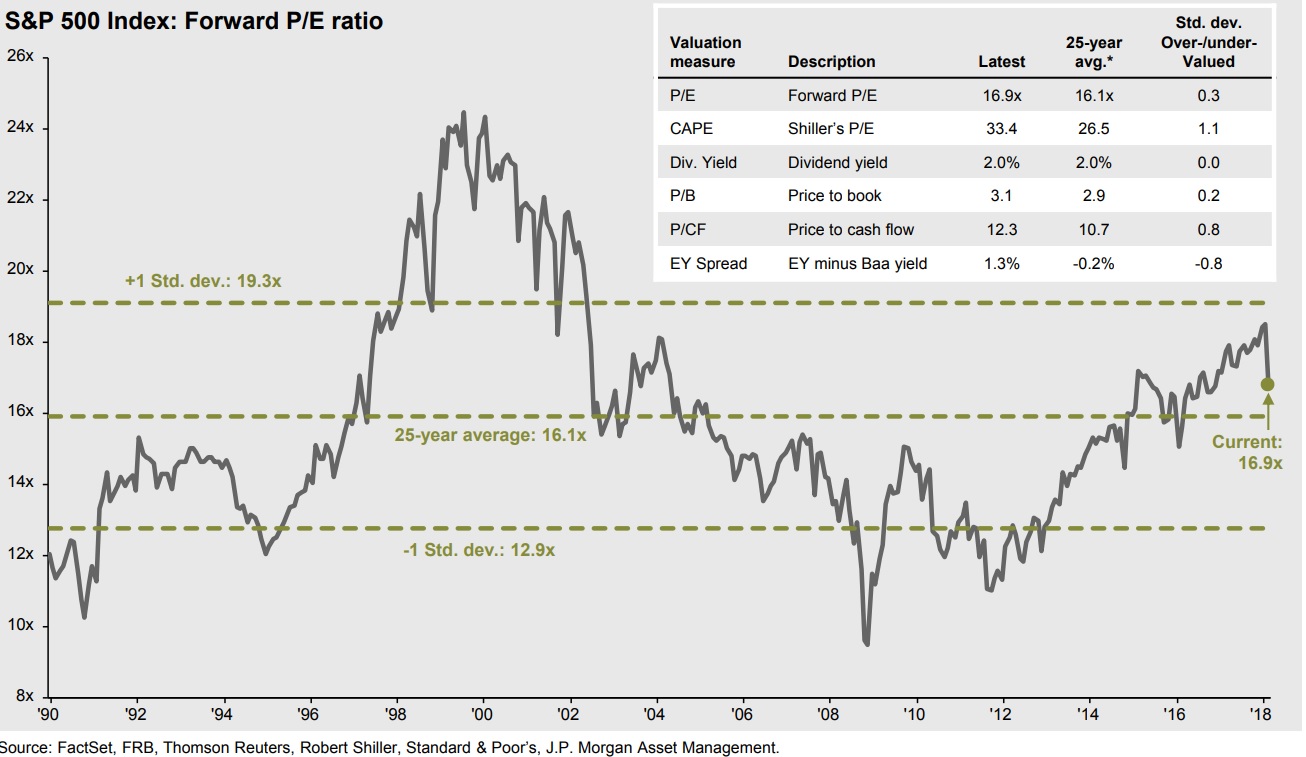

After a solid bull market, a key concern of many investors is – are the markets overvalued? Lets look at…

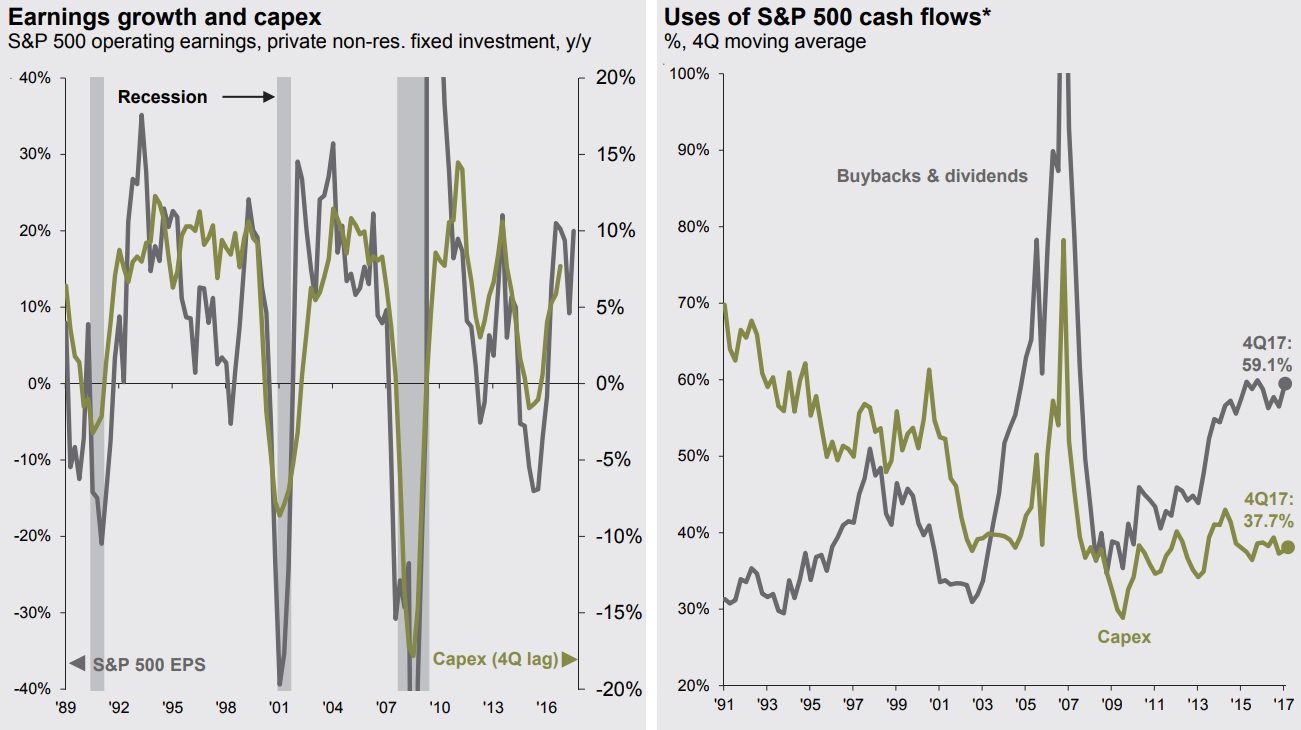

During this recovery and BUSINESS cycle corporations prefer payouts vs Capex One hallmark of current recovery and business cycle has…

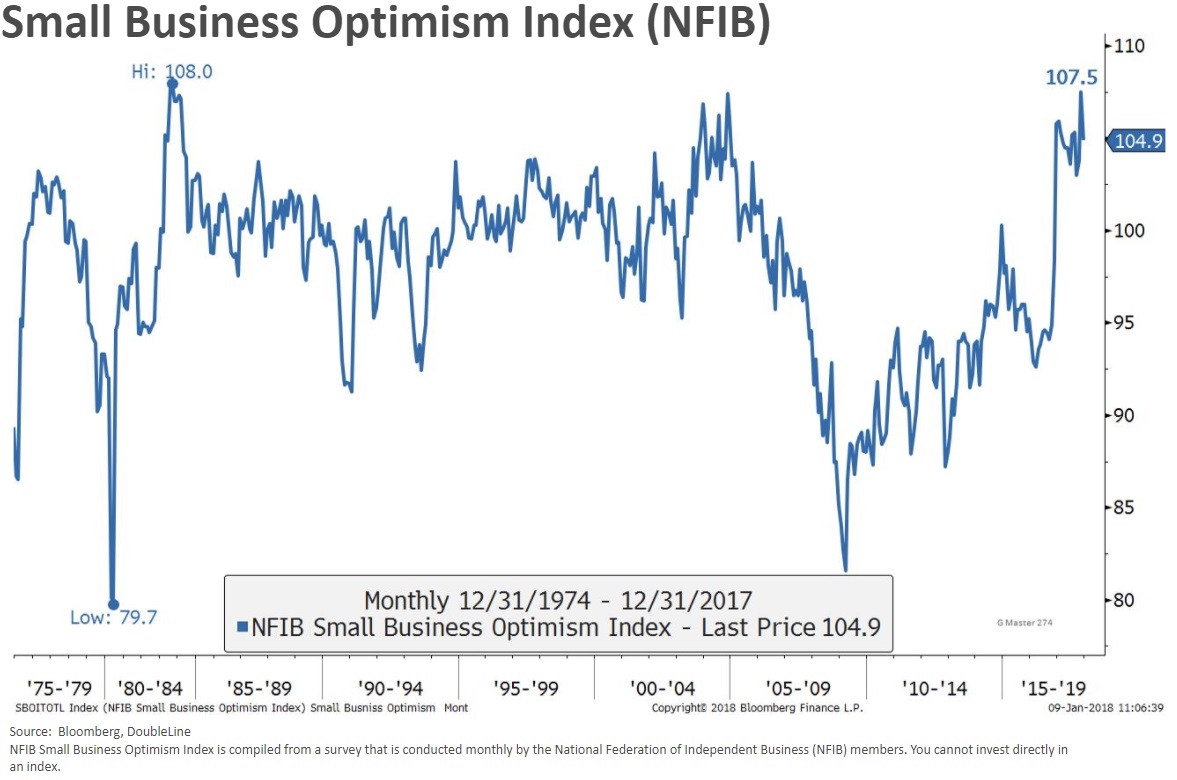

Small Business Optimism Index is near to the highest recorded level of 1981. The Index indicates strong economic prospects It…

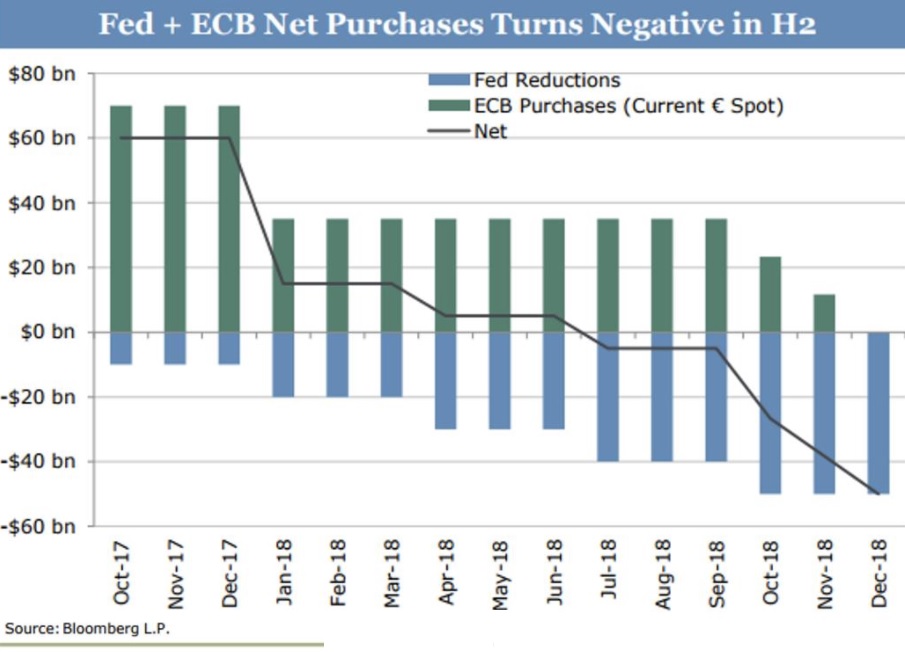

U.S. Federal Reserve and EU Central Bank are planning to reduce money supply during 2018. U.S. Fed plans to continue…

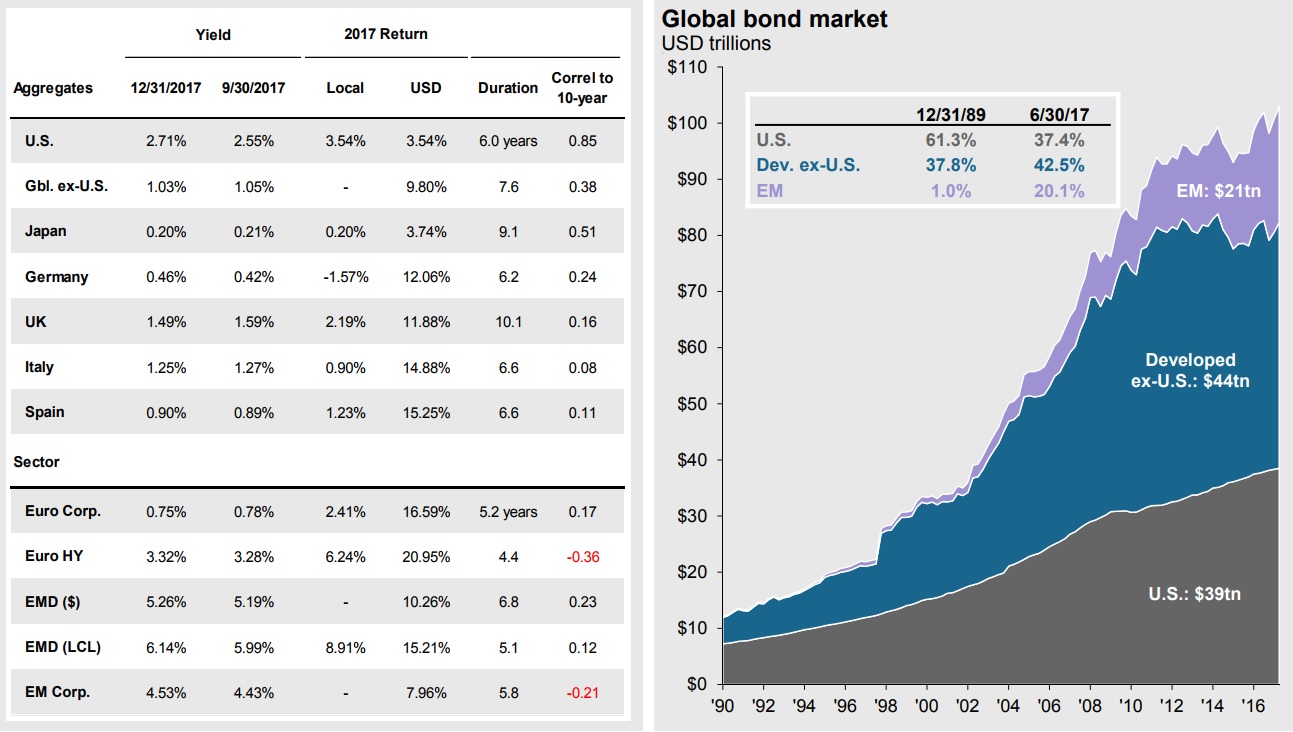

With most central banks tightening money supply and increasing rates what to expect of global fixed income markets Across developed…