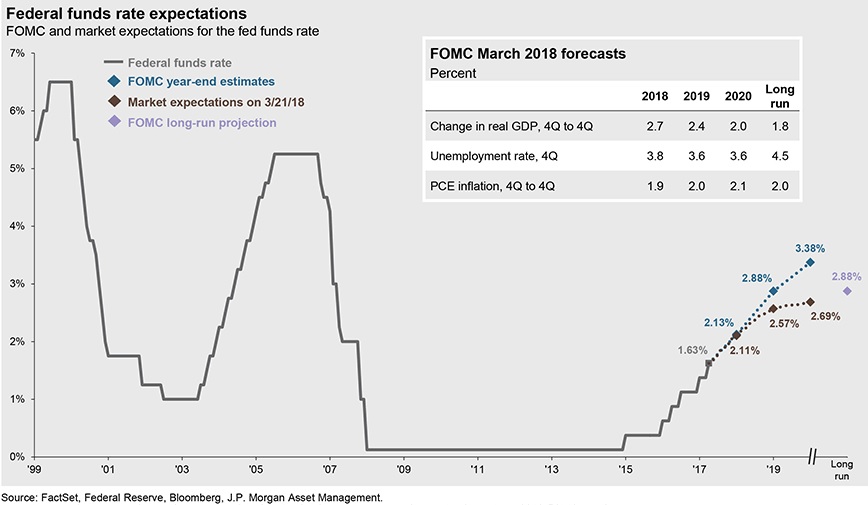

Rates moved steadily higher as financial markets gyrated in April. Yields on 10-year U.S. Treasury’s broke through the magical 3.0%…

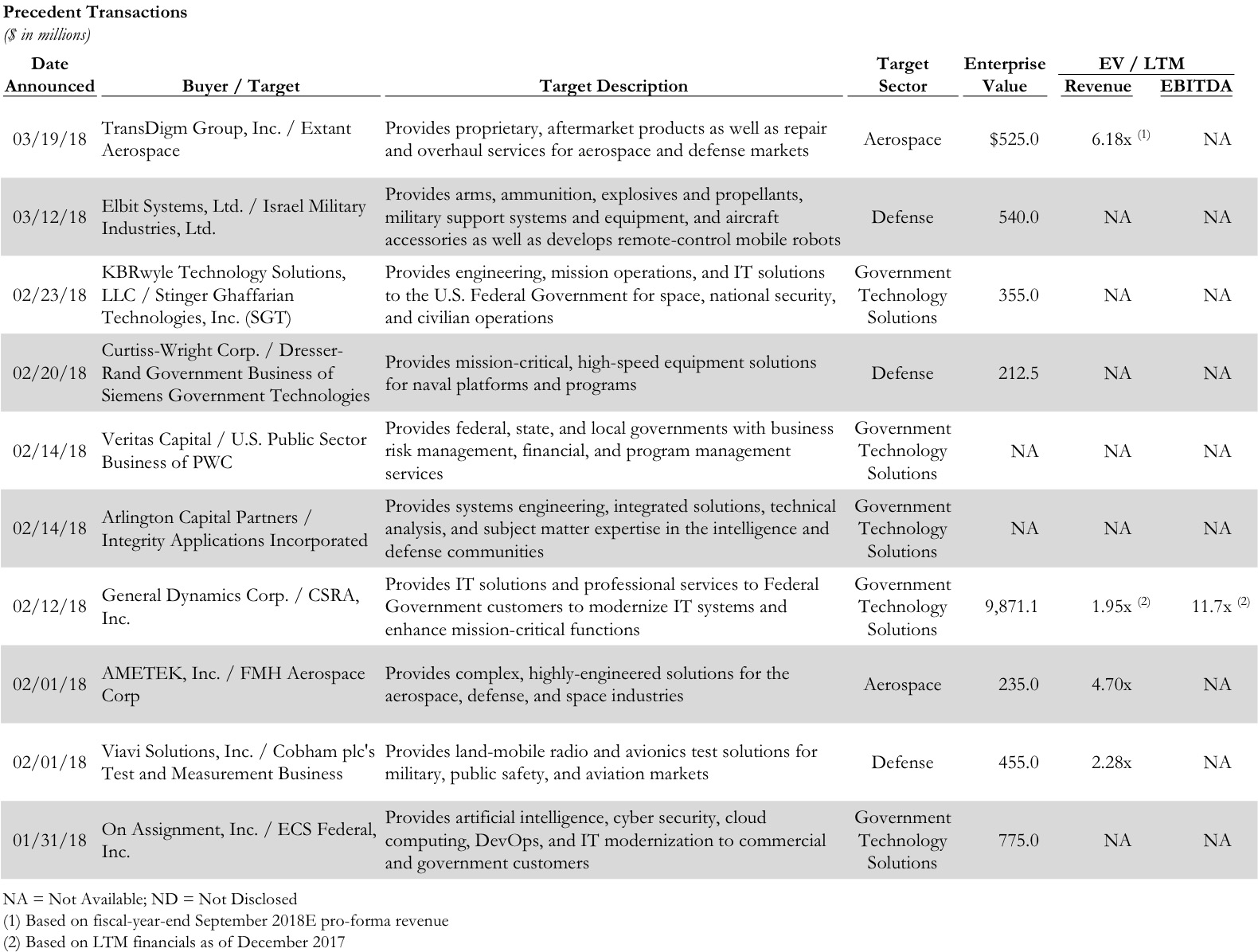

There were 98 A&D deals announced in Q1 2018, a decrease from Q4 2017 Transaction volume increased by 8.9% YOY…

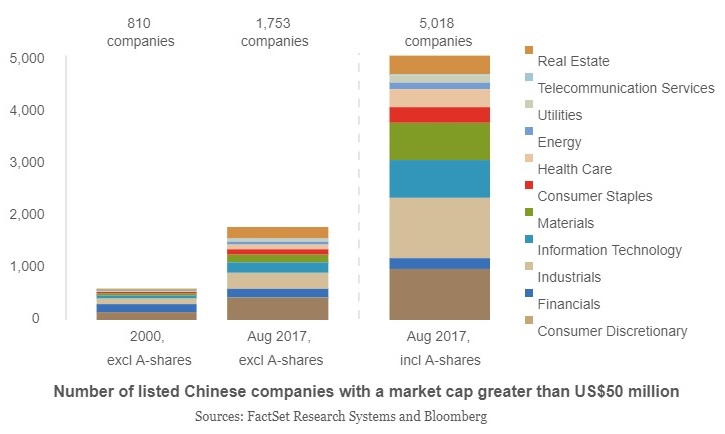

The liquidity, depth and breadth of China’s listed companies is now second only to the U.S. Number of listed Chinese…

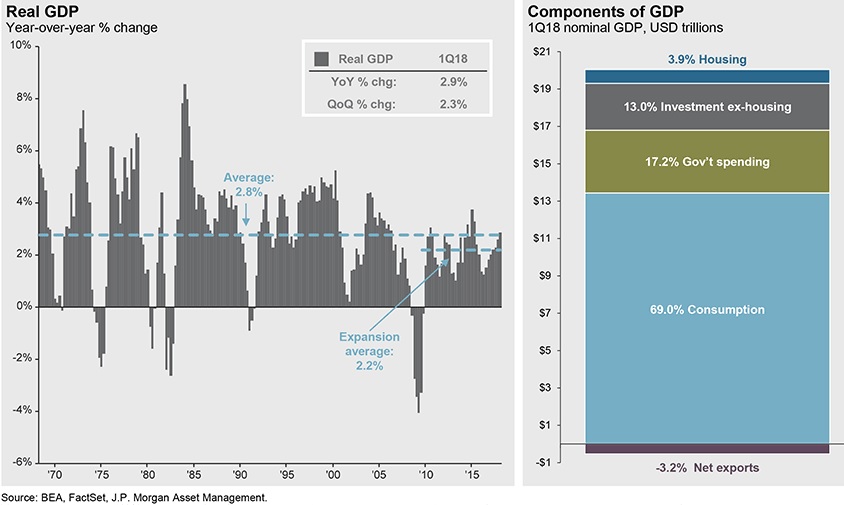

This has been a slow but resilient expansion This economic expansion has been like a healthy tortoise – slow but…

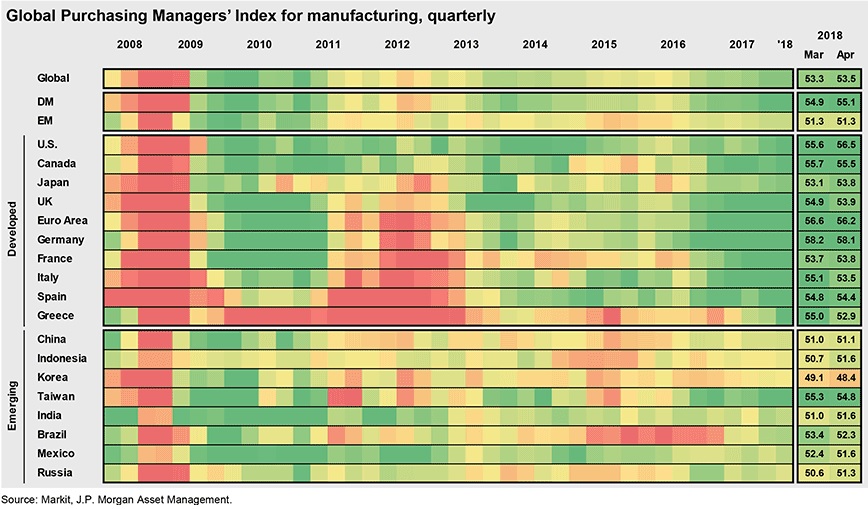

After two years of very mediocre growth and various setbacks over the last decade, the global economy started to show…

In 2011, we supported the creation of When Bankers Were Good, a documentary about a time when banks and bankers were…

Epic Hospitality Group (a Defoe Redmount portfolio company) takes over Regency Park Suites, a 120-room upscale extended-stay suites hotel in…

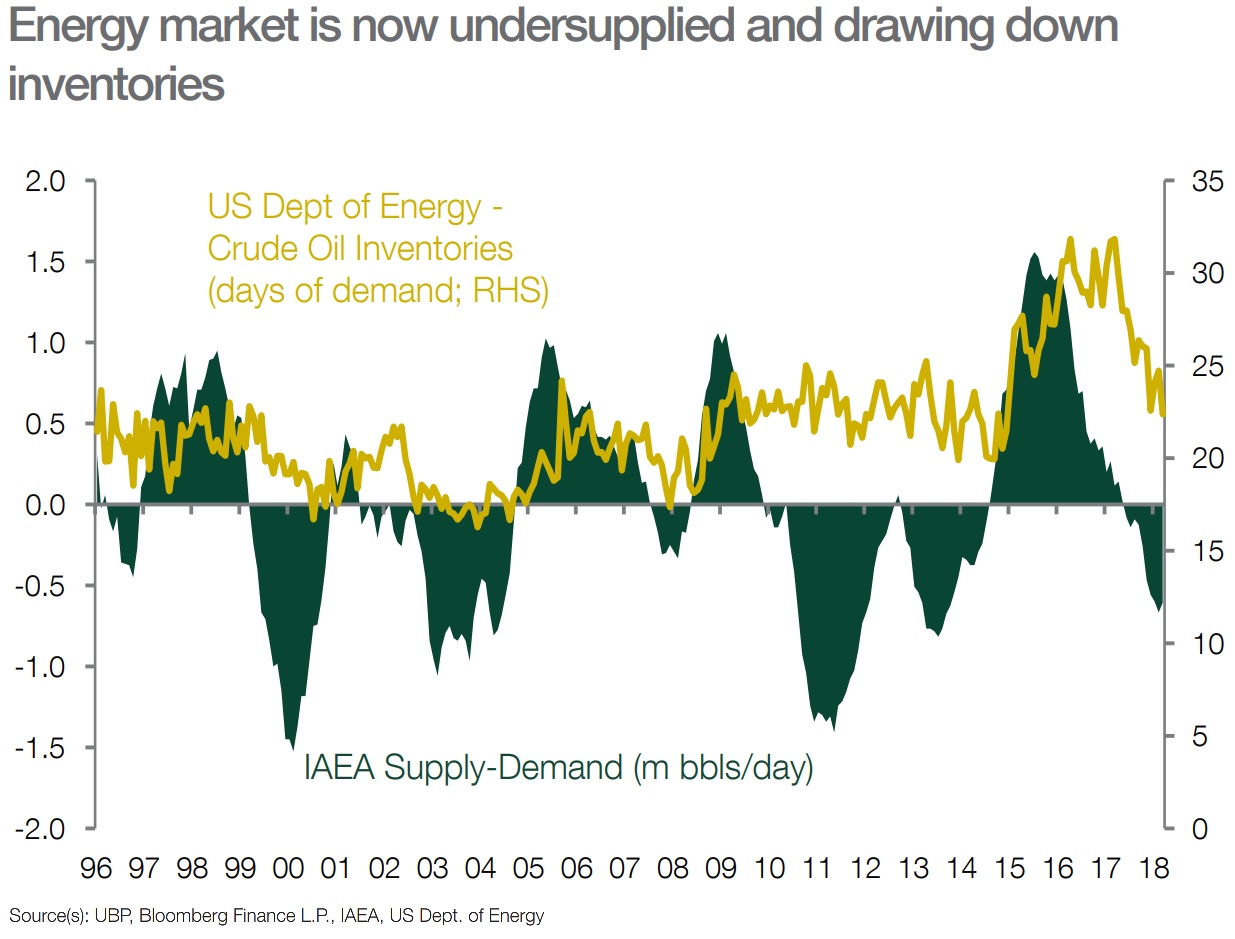

Energy sector out-performance lies ahead Having ended 2017 as one of the worst performing global sectors, sustained out-performance lies ahead…

Selling shares in a business completely (or partially) income tax-free sounds too good to be true, right? Perhaps not. To the delight…

owners of long cash conversion businesses are finding alternative funding solutions such as invoice finance are allowing them to execute…